What is Equipment Depreciation?

Equipment depreciation refers to the gradual decrease in the value of machinery, tools, or other physical assets over time due to wear and tear, age, usage, and technological obsolescence. This accounting concept is crucial for understanding the long-term costs associated with maintaining and replacing equipment, and it directly impacts maintenance planning, budgeting, and asset management.

Purpose for Maintenance Managers

Equipment depreciation is not just an accounting term but an essential aspect of strategic decision-making for maintenance managers.

Understanding how equipment loses value helps them make informed decisions regarding maintenance investments, repair versus replace considerations, and optimizing asset lifecycles.

Equipment typically undergoes depreciation for several reasons. Physical wear and tear from everyday use reduces its efficiency and performance. Exposure to environmental factors, such as moisture, dust, and temperature fluctuations, also contributes to the declining value.

Additionally, technological advancements can render older equipment less efficient or obsolete, impacting its market value and performance capabilities.

Maintenance managers must understand the depreciation schedule for each piece of equipment, often provided in years of useful life. This schedule indicates how long a machine is expected to remain operationally viable before it becomes too costly to maintain or is replaced.

Equipment depreciation schedules are determined using different methods, such as straight-line depreciation (where value decreases evenly over its lifespan) or accelerated depreciation (where value drops faster during the initial years of use).

Impact on Maintenance Strategy

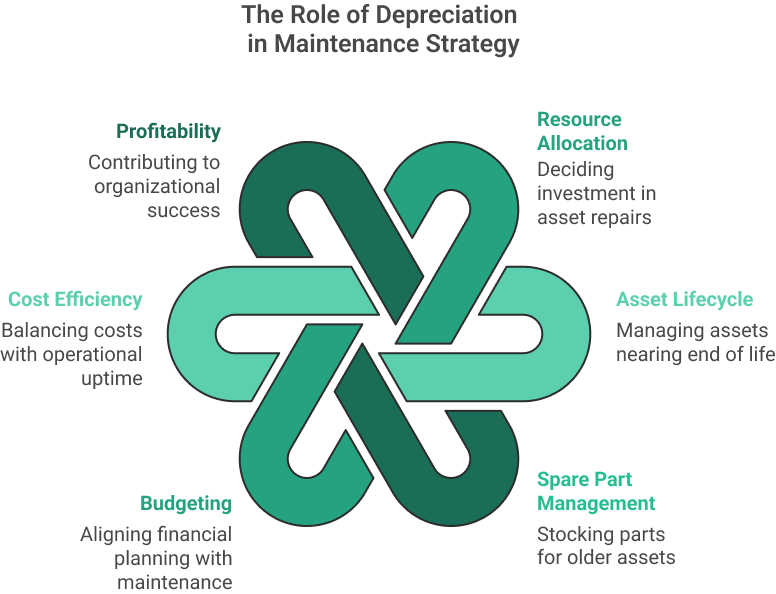

Depreciation helps maintenance managers decide how much effort and resources should be allocated to specific assets. Equipment near the end of its useful life might warrant less investment in extensive repairs, as it is more cost-effective to replace than repair repeatedly.

Furthermore, depreciation affects spare part management, as older assets may require increased part stocking, which can become uneconomical over time.

A well-rounded understanding of equipment depreciation is key for effective budgeting, minimizing unexpected breakdowns, and ensuring that maintenance strategies are aligned with financial and operational goals.

Correctly accounting for depreciation ensures a balance between operational uptime and cost efficiency, ultimately contributing to the organization’s profitability and sustainability.

How to Calculate Equipment Depreciation

1. Straight-Line Depreciation Method

This is considered the most commonly used method, and it is also the simplest to track.

How to Calculate Straight-Line Depreciation Method?

Depreciation Expense = (Cost of Equipment – Salvage Value) / Useful Life

- Cost of Equipment: The initial purchase price of the equipment.

- Salvage Value: The estimated residual value of the equipment at the end of its useful life.

- Useful Life: The number of years the equipment is expected to be in service.

Example: If a machine costs $50,000, has a salvage value of $5,000, and a useful life of 10 years, the annual depreciation would be:($50,000 – $5,000) / 10 = $4,500 per year

Straight-Line Depreciation Calculator

Straight Line Depreciation Calculator

Annual Depreciation

Depreciation Rate

2. Declining Balance Depreciation Method

This accelerated method depreciates equipment faster in the earlier years of its life.

How to calculate Declining Balance Depreciation Method?

The formula to calculate Declining Balance Depreciation Method is as follows:

Depreciation Expense = Book Value at Beginning of Year × Depreciation Rate

The depreciation rate is often double the straight-line rate, known as Double Declining Balance (DDB).

Example: If the same machine has a useful life of 10 years, the DDB rate would be 2 / 10 = 20%. In the first year, the depreciation would be $50,000 × 20% = $10,000.

3. Unit of Production Method

This method is helpful for equipment whose wear and tear are more closely related to usage than time. To formula to calculate Unit of Production method of depreciation is as follows:

Depreciation Expense = (Cost of Equipment - Salvage Value) / Total Estimated Units of Production × Units Produced in the PeriodExample:

Example: If a machine costs $50,000, has a salvage value of $5,000, and is expected to produce 100,000 units, the depreciation per unit is ($50,000 - $5,000) / 100,000 = $0.45 per unit. If 8,000 units are produced annually, the depreciation expense would be 8,000 × $0.45 = $3,600.

Examples of Maintenance Organizations

- Manufacturing Plant Machines: A CNC milling machine might have an estimated useful life of 10 years. Straight-line depreciation would allocate an equal portion of its value as an expense annually. Understanding this allows maintenance managers to align major overhauls or replacement plans with the end of the machine's useful life, thus avoiding excessive spending on a nearly obsolete machine.

- Vehicle Fleet: Consider a service vehicle used for transporting maintenance crews and parts. The vehicle may depreciate significantly in the first three years due to intensive use. Maintenance managers would need to evaluate whether the cost of maintenance post-depreciation justifies keeping it or if replacing the vehicle would be more cost-effective.

Get a Free WorkTrek Demo

Let's show you how WorkTrek can help you optimize your maintenance operation.

Try for free