Get a Free WorkTrek Demo

Let's show you how WorkTrek can help you optimize your maintenance operation.

Try for freeFor several years now, the infrastructure community has been talking about sound management of municipal infrastructures, sustainable management and more recently, asset management.

Generally, fixed asset management is a set of practices that facilitate rigorous decision-making based on knowledge of assets: their condition, associated risks and costs in order to achieve the organization’s objectives. In the case of a municipality, the organizational objectives are to provide services to citizens in a safe and sustainable manner while demonstrating responsible management of revenue from municipal taxes. The implementation of an asset management process allows elected officials to have all the elements in hand to make the best decisions and to effectively manage the assets of their municipality.

The investment lifecycle may be streamlined with the help of modern technology, which also makes managing deals from start to finish simpler. Teams can cooperate, and all stakeholders can access the same data and insights from a single centralized data repository.

Asset Management: How Can It Be Defined And What Are Its Principles?

We can define asset management as this operation which consists of managing funds from one or more partners with the aim of making them grow as much as possible. Of course, capital gains will be realized over a long period following this operation. Thus, in order to maximize profits, one must invest not only in stocks but also mutual funds.

Of course, investing in open-ended investment companies will also maximize profits. It is important to take into account certain obligations in order to be able to increase the yield.

Portfolio management is based on four principles. These 4 principles of Asset Management are the main values on which its practice is based in order to achieve the various objectives. These include value, leadership, alignment and collateral.

The value – The role of assets is to give value to the organization that owns it. So, asset management mainly focuses on the value that the asset could bring to the said organization.

Leadership – Very important to create value, the role of leadership is to set up asset management, but also to ensure its effective use in the organization itself.

Alignment – The different objectives of an organization manifest themselves not only in activities and plans, but also in technical and financial decisions. The smallest decision that will be taken will count a lot to achieve the various objectives of the organization.

Warranty – It is certified by the asset management that the assets will perform their function. The guarantee concerns not only the assets, but also their management and the management system.

Why Do Asset Management And What Are The Asset Management Solutions?

While investing their funds in productive assets, asset managers allocate capital very efficiently. Note that these funds come from private and institutional investors. The advantages of asset management are numerous. However, to benefit from these advantages, the assets in question must be entrusted to an effective manager.

The latter must be able to put in place a good inventory management strategy. Thanks to the latter, the asset manager will be able to have a look at all the assets in his possession. Businesses will be able to make the most of their resources without wasting their funds on bad investments.

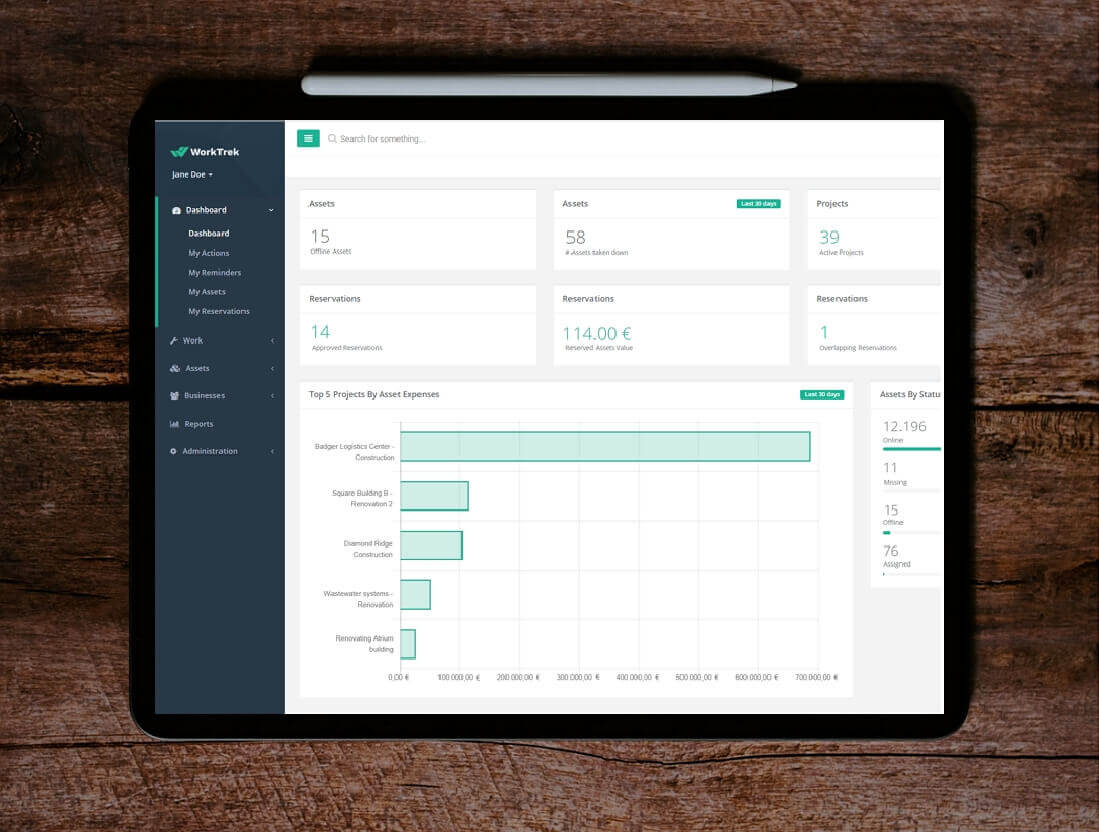

Also, with the main objective of making the assets of clients prosper, some managers opt for the use of software. By opting for the use of software, they offer themselves many other possibilities such as:

- the ability to manage resources anywhere;

- keep track of all assets;

- forecasting risks, whether legal, operational or financial;

- the implementation of asset management operations more efficiently with much more effective monitoring;

- optimization of management time;

- determination of service levels;

- monitoring and measuring the life cycle of an asset;

- and the management of active portfolios.

The software in question is an asset management solution through which investors can structure their assets. Two options are available to them, namely: internalize or outsource.

Manage assets with the latest technology!

Manage assets quickly and easily with WorkTrek!

Try for freeIn sourcing

Buying and using software internally. The objective for the investor is to carry out, analyze and carry out an effective management of the investments. To do this, he may use computer products or software. These are easily available in the market. It is also very important that the investor regularly expands his knowledge given the continuous development of products.

Outsourcing

Involves the use of software made available by others. This software is offered by a service provider and makes it possible to avoid the independent exploitation of computer products. While accessing the investor’s data, the service provider provides assessments, analyzes and any other necessary information to the investor while taking into account his needs.

To determine that management software is effective, it must be able to focus on the condition and performance of assets. It is also considered efficient if it manages to create a rapid return on investment, improve operational efficiency, reduce costs, raise the level of compliance, reduce various administrative tasks, etc.

Making Use Of Current Technology For Asset Management

Asset management involves a great deal of activity, making the manual workflow tiresome and ineffective. It will undoubtedly be challenging for a firm with many assets to manage and make use of them. Fortunately, most corporate operations can now be automated in the digital age, which makes it easier for firms to remain flexible.

What Technologies Are Employed in Asset Management?

Analytics of Data

One of the most crucial elements of asset management is data analytics. Due to its value in analyzing asset performance, which aids the company in making decisions that are well-informed. It can offer essential data that aids companies in establishing baselines and future targets in order to calculate the performance of an asset.

Tags & Labels

Labels and tags can be extremely important for efficient asset management. Since they constantly give real-time information and asset locations. Each asset has a label that is fastened to it, and the asset management software records the label’s special identifying number. This tag automatically provides all the information associated with it once it is scanned. The tag offers precise information. There are numerous asset tracking technologies available that come in label chips, tags, etc.

Artificial intelligence

Particularly in the manufacturing sector, artificial intelligence is crucial for enhancing daily operations and maximizing asset performance. Numerous methods, including troubleshooting, locating, and eliminating bottleneck problems, are employed in order to do so, but artificial intelligence is primarily used. You can learn more about asset behavior using artificial intelligence, which can aid you in making wiser decisions. Additionally, by using this information, you can enhance asset performance and, in the event that unexpected failures happen regularly, you can find the source and effectively resolve the problem.

Cloud technology

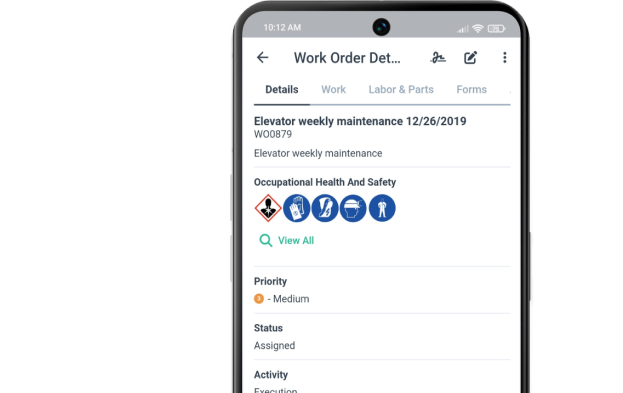

One of his most important technologies in asset management is cloud technology. Cloud-based asset management software allows businesses to access it from anywhere in the world. Changes during operation and maintenance work are also possible. Additionally, work orders can be created based on priority or based on requirements to maximize productivity. Apart from that, you can get a customized report according to your requirements in just a few clicks. See the real-time location of all your assets on your device.

Contribution Of Technology To Asset Management

The use of technology assets has improved office functions and client relationships in fund administration, as in other industries, and money managers are quick to adopt technology. Executives across all lines of business emulate some of the principles wealth managers use to manage elements of their business in terms of asset performance and use technology to measure and monitor progress.

The Covid-19 pandemic has accelerated the development of all these technologies. In addition, the increased automation of various wealth manager-specific tasks such as data management, risk assessment, market research and analysis, asset trading, and customer service is a result of the use of technology in wealth management.

Why Technology Matters

For wealth managers to evolve and grow, they must embrace change and integrate next-generation technology stacks into their daily processes. It helps you excel:

Keep regulators happy – Since the 2008 financial crisis, regulators around the world have gradually tightened their transparency and reporting requirements. Wealth managers have no choice but to comply. The European Union has done it. In September 2020, the European Securities and Markets Authority introduced new liquidity stress testing guidelines. This requires fund managers to stress test the fund’s assets and liabilities to address liquidity risk. In March 2021, the Sustainable Finance Disclosure Regulation came into force. Asset managers are required to be more transparent about the sustainability of their financial instruments and to disclose how sustainability risks are integrated into the investment process.

Stay competitive in a rapidly changing market – In recent years, the pressure to generate exorbitant returns has pushed wealth managers up the risk curve towards more illiquid asset classes and more complex investment strategies. The investment climate is now becoming increasingly unpredictable, with resurgent geopolitical volatility, the end of globalization legitimacy, the threat of climate-related shocks, and doubts about the strength and sustainability of the “Fed put.”

Meeting Investor Service Expectations – Investor demand for transparency is also increasing. Allocators (especially institutional investors) want detailed and understandable insight into the level and sources of money her managers’ performance, as well as sophisticated risk indicators on a variety of factors.

Conclusion

Modern technology and CMMS software streamlines the investment lifecycle, simplifies end-to-end deal management, team collaboration, and access to the same data and insights for all stakeholders and from one central data location.