Get a Free WorkTrek Demo

Let's show you how WorkTrek can help you optimize your maintenance operation.

Try for freeDeducting the full cost of a machine in the first year doesn’t make sense when the machine will be used for 8 to 10 years. To address this, the accounting field introduced the concepts of fixed assets and depreciation. This approach spreads the machine’s cost over its useful life, reflecting its ongoing value and usage.

Introduction: The Balance Sheet And The Fixed Assets Register

It seemed difficult to us to approach the concept of fixed assets without introducing you to the documents in which they appear, namely the balance sheet and the register of fixed assets.

The balance sheet is a mandatory accounting document for companies, which reports their assets at a given time. It is made up of two parts, assets and liabilities, which absolutely must be balanced (the sum of each part must be equal to each other).

The fixed assets register is a simplified version of the balance sheet.

The Liabilities Of The Balance Sheet

Liabilities are a statement of the company’s financial resources. It includes internal and external resources, in other words equity and debt. It is frequently said that liabilities have a negative economic value for the company.

Liabilities are made up of three sub-parts that we will present to you in their order of appearance in the balance sheet:

1. Equity

They relate to the company’s long-term stable resources. Three key resources make it up: share capital, reserves and net income.

Share capital is the money contributed by the partners of the company when it was created. They constitute the initial contribution of the creators of the company.

Company reserves are the results of previous years not distributed to the company or its creators. They constitute its treasury.

The net result is the difference between the income and the expenses for the financial year. It can be positive or negative and balances the balance sheet. Concretely, it is calculated by subtracting the total of liabilities from assets. It is always entered in the liabilities of the balance sheet, being considered as a debt of the company towards its partners.

2. Provisions for risks and charges

Provisions for liabilities and charges show future events such as charges in the balance sheet, which must be precisely and reliably estimable and highly probable.

3. Company debts

Consisting of the company’s resources, debts are distinguished between short-term debts (less than one year), medium-long-term debts (loans) and operating debts (suppliers, VAT, wages, etc.).

The Assets Of The Balance Sheet

Assets represent all of your company’s assets. It is in a way an inventory of the goods and rights that it possesses, presented in increasing order of liquidity (ability to be transformed into money). It is located in the left column of the balance sheet and the sum of all assets must be equal to the sum of all liabilities: what the company owns must be equal to its resources (equity + debt).

To be considered as such, an asset must meet four criteria according to the General Accounting Plan:

- An asset must be identifiable;

- It must have a positive economic value, i.e. provide the company with an immediate or future economic benefit;

- It must be controlled by the company, which assumes the risks and benefits. For example, it cannot credit the machine of a supplier, who is responsible for the risks associated with this asset;

- Finally, an asset must be able to be valued at its fair value and reliably.

Examples of assets: goodwill, building, equipment, receivables, patents, etc.

Fixed Assets Or Current Assets?

The assets of a balance sheet have two distinct parts, and this is where we come back to the principle of fixed assets: there are fixed assets and current assets.

Fixed assets are made up of durable goods, i.e. goods that can be reused in the medium to long term (more than one year), which the company owns and which are used in the exercise of its activity. As we will see later, a distinction is made between tangible, intangible and financial fixed assets. Examples of fixed assets: premises owned by the company, office furniture, computer, etc.

On the other hand, current assets include all the other assets which do not remain permanently in the company’s assets, and/or which are transformed (stocks transformed into product, receivables becoming cash upon settlement, etc.) or even the cash, intended to be reinvested in the company or to absorb hard knocks such as a breakdown of equipment. So now you have a better understanding of where an asset is and what it is used for in the balance sheet. But back to our sheep and see together what is, concretely, an immobilization.

The Fixed Assets Register

Easier to keep, the fixed assets register only provides information on fixed assets: durable goods owned by the company. The elements contained in the fixed assets register are:

- The date of acquisition of the property,

- The nature of the immobilization,

- The price,

- Details of the depreciation applied each year since the purchase of the property,

- The date of transfer if applicable,

- The transfer price if applicable.

Definition Of A Fixed Asset

The accounting fixed asset is the whole of the company’s assets, and the depreciation makes it possible to deduct a portion of the initial investment each year.

But concretely, what is an immobilization? Fixed assets are assets held and used by the professional in the course of his activity for more than one year. Indeed, the general chart of accounts considers them as goods or assets whose use extends beyond the current financial year. They allow the business to earn money or allow it to operate normally. There are three categories: tangible, intangible and financial assets.

- Fixed assets: all physical goods, which one can touch. Examples: vehicles, premises, equipment, etc.

- Intangible assets: the immaterial assets of the company. Very rare in private practice, they generally only concern the patients of a practice. Examples: patents, licenses, trademarks, software, goodwill, etc.

- Financial assets: intangible financial assets (shareholding, loan granted to other companies, etc.)

Certain assets must be recorded in the company’s fixed assets: goodwill, equipment specific to the professional activity (a doctor’s table, a massage therapist’s machine, a photographer’s camera …). Other property can be used professionally and personally, such as a vehicle. In this case, either the self-employed person brings the property into the company’s professional assets and immobilizes it, or he brings it into his personal assets and therefore cannot immobilize and depreciate it. This applies to all major mixed pro/personal purchases such as computers or mobile phones.

Whatever the nature of the fixed asset, it must be included in the fixed assets register or the company’s balance sheet. The main advantage of fixed assets is to be able to deduct part of the purchase cost each year.

What Is An Asset?

Fixed assets are assets owned by a business that are used for the long term and not intended for resale.

These fixed assets constitute a favorable potential economic value for the organization.

Fixed assets are an integral part of an accounting practice. There are three main categories:

-

Intangible asset:

Intangible assets are non-monetary assets without physical substance, which represent a profit for the organization. This type of fixed asset includes assets such as software or patents.

-

Tangible fixed assets:

Property, plant and equipment, on the other hand, are physical assets owned by a business that can be used by the business or rented out to other organizations.

This type of fixed asset includes assets such as machinery, tools, equipment or land.

-

Financial fixed assets:

Finally, financial fixed assets are durable assets also owned by a company. For example, financial loans to associates for a period of more than one year.

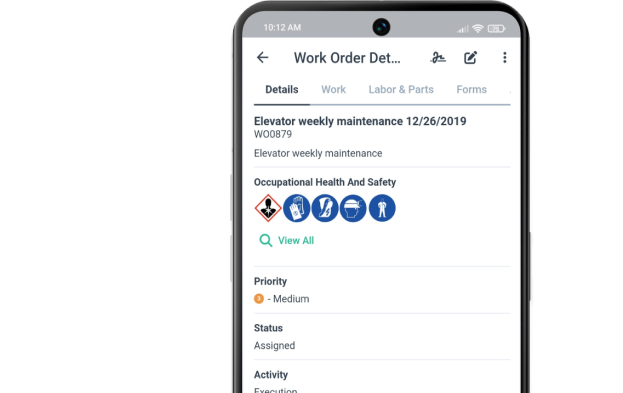

Why Is It Essential To Manage Your Fixed Assets?

For a business, it is important to track all of its assets with fixed asset management software.

With this type of software, an organization can get an accurate idea of its fixed asset stock and its book value. It can also manage:

- Census of assets and their characteristics,

- Visibility on the use of software & hardware to better predict investments,

- Depreciation management: calculation, depreciation plan,

- Automatic amortization schedule update, revaluation,

- Make the link between equipment acquisitions and the current state of the capital stock (functional, lost, broken, etc.),

- The end of the asset lifecycle,

- Determine the capital gains or losses of fixed assets to see which are the most profitable for the company.

This makes it possible in particular to apply the tax regulations in force and to limit the risk of error linked to the calculations of depreciation, which are done manually.

What Is Amortization?

Depreciation is the distribution of the amount of a fixed asset for the total period of its use. This technique is based on the use that the company makes of an asset.

The duration for which a fixed asset is operated is determined by the company so that it can provide for a depreciation schedule.

Depreciation allows a company to reduce certain costs and to know exactly when an asset needs to be replaced.

Accounting Depreciation Of Fixed Assets

Accounting depreciation consists of deducting a portion of the purchase cost of fixed assets every year in order to amortize this cost over several years. The fixed asset is effectively intended to remain in the professional heritage for a long period. Its purchase price can therefore be divided. Please note that only tangible fixed assets can be subject to depreciation. You must also be in the actual tax regime to be able to deduct depreciation, micro regimes are excluded.

Depending on the nature of the asset, we opt for more or less long amortization periods. Examples:

- 4 to 5 years for vehicles and other means of transport;

- About 10 years for furniture (desk, professional table, etc.);

- 8 to 20 years for specific arrangements and installations (creation of a photographic studio, a gym or rehabilitation room, etc.);

- 3 years for computer equipment (computer, printer, telephone, etc.);

- 20 to 50 years for locals;

- About 5 years for electrical equipment.

All these goods are to be depreciated in proportion to their professional use, regardless of the purchase price. There is, however, an exception for the purchase of small equipment and office furniture not exceeding 500€, in which case you can have this expense transferred directly to professional expenses.

Improve your business and optimize it with WorkTrek!

Monitor your fixed assets to avoid unnecessary losses!

Try for freeWhat Are The Challenges Of Good Fixed Asset Management?

The challenge of managing fixed assets lies in their effects on your income statement. When your company incurs an expense, for example the purchase of cartridges for your printers, these costs are deducted from your result. They constitute expenses of the exercise. Mechanically, the result decreases by the amount of the charge. But when your business acquires property or makes an expense that will be capitalized, in accounting terms, this produces two effects.

On the one hand, this investment is value-neutral to your business. This property is included in the company’s assets as we have seen above. The outflow of cash is offset by the entry into the asset side of an asset of the same value. This nevertheless contributes to the constitution of the company’s assets.

But, in some cases, the investment may give rise to the calculation of amortization, that is to say that we will take into account its loss of value over time, either related to its age, or to its obsolescence.

This amortization will therefore also have an effect on your results, but over time, over several accounting years. However, amortization can be calculated in different ways (linear or decreasing in particular), each having advantages and disadvantages that should be identified according to the situation, the company not always having the choice of the mode of amortization.

Example

Example of the linear depreciation of the machine tool purchased on January 1, 5000 euros:

The company decides to amortize it over 5 years. It will therefore incur a depreciation charge each year. We are talking about depreciation charges. This will therefore be equal to the acquisition value divided by the duration in years of the amortization, i.e. 5000/5 or 1000 euros per year. In other words, the result of each financial year will include a depreciation charge of 1000 euros for five years.

Conclusion

To sum up, the accounting fixed asset is the fact of integrating goods into the professional assets of the company. Tangible assets are depreciable over several years, depending on the nature of the asset. When reselling a fixed asset, its book value must be taken into account in order to treat any capital gain or loss as revenue or expense.